As practitioners, we use heuristics—mental shortcuts or “rules of thumb”—all the time to navigate complex, uncertain, and time-sensitive legal challenges. These cognitive shortcuts usually serve us well, especially as we get older and have more professional experience to draw upon. But sometimes those same mental shortcuts can act as blinders.

For example, assume you’re looking at a revocable trust agreement that was partially handwritten by a non-lawyer over twenty years ago. When you pick up that document you’re probably not thinking “deed;” it looks nothing like a deed and doesn’t even call itself a deed. So no deed, right? Maybe. Why?

Because under the right circumstances a trust agreement can be the functional equivalent of a deed. In other words, the document you’re looking at isn’t what it purports to be (a revocable trust), it’s something else (a deed). That kind of insight can make all the difference in the world in a contested probate proceeding, where title issues loom so large. Which is exactly what the parties in the Fuentes case learned.

Case Study

Fuentes v. Link, — So.3d —-, 2024 WL 3049415 (Fla. 3d DCA June 19, 2024)

This case involved a man who died in 2020 without a will (intestate). The decedent was survived by a spouse and two children from a prior marriage. The decedent owned a home at the time of his death. If the home was part of the decedent’s probate estate when he died, it would be split 50/50 between his surviving spouse and his children from his prior marriage. If the home was previously deeded to spouse, it would be owned 100% just by spouse.

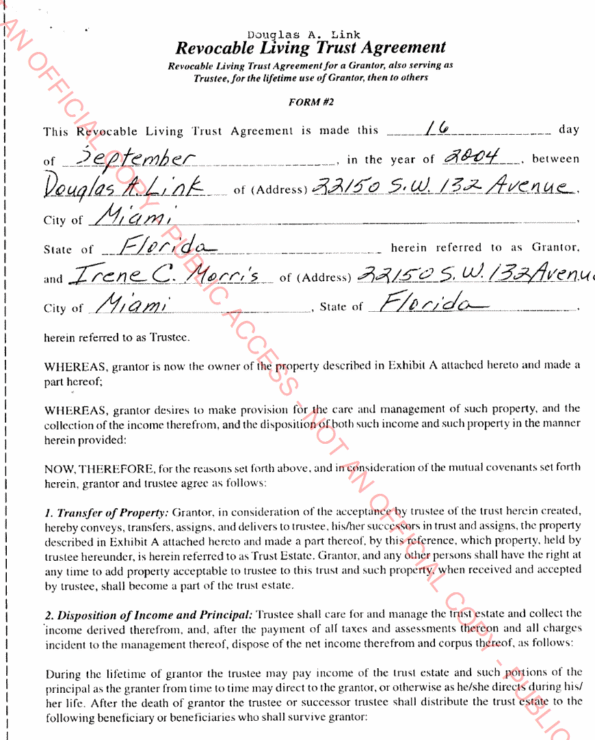

Daughter claimed the house was a probate asset. Spouse claimed the house wasn’t a probate asset and it belonged 100% to her because back in 2004 her husband had deeded the house to her. This “deed” was in the form of a revocable trust agreement that looks like some kind of form downloaded from the internet the decedent filled in by hand. This kind of do-it-yourself legal work often ends badly, but not always. In this case the trust agreement met all of the requirements for a deed under F.S. 689.01(1), and according to this trust agreement, the house belonged to spouse. Here’s what happened next:

The parties brought cross-motions for summary judgment, and after a non-evidentiary hearing, the trial court found in favor of Irene, relying on this court’s decision in Flinn v. Van Devere, 502 So. 2d 454, 456 (Fla. 3d DCA 1986), and entered final summary judgment finding that the trust agreement here effectively functioned as a deed containing all required elements for a valid conveyance. This appeal followed.

Can a revocable trust agreement function as a deed? YES

By training and experience, most of us would assume a document that’s not labeled a “deed” and that’s not recorded for 16 years isn’t going to work as a deed. And we’d be wrong. Why? Because when it comes to conveying legal title to real property what matters isn’t labels, it’s the substance of what the document actually says, and whether the document was actually executed with the formalities required of a deed. As noted by the 3d DCA:

The trial court correctly noted that there are no other strict form requirements for a deed, nor is there any requirement that the document be labeled a “deed.” See Saltzman v. Ahern, 306 So. 2d 537, 539 (Fla. 1st DCA 1975) (“Technical words of grant or conveyance are not essential in order for a deed to operate as a conveyance.”); see also Flinn, 502 So. 2d at 455 (suggesting that trust documents can be “regarded” as a deed if they “comply with the necessary formalities of two witnesses and an adequate legal description” and contain an “expression which purports to convey, grant or transfer the real estate”).

But how could a “revocable” trust agreement that was never recorded convey title? If the document was revocable and was never recorded, the decedent could have changed his mind anytime prior to his death. Wouldn’t these facts doom wife’s claim to title? Nope. So saith the 3d DCA:

Donna offers only the fact that the trust instrument was revocable and unrecorded during Douglas’s life to suggest that there’s an issue of fact regarding intent. But that, without more, can’t be right. Most revocable trusts aren’t revoked, but of course some are, and neither unremarkable proposition speaks to Douglas’s intent. At best, the fact that the trust is revocable and unrecorded creates a “merely colorable” argument, but one which “is not significantly probative” of intent. In re Amends., 309 So. 3d at 193 (explaining that nonmovant must present more than mere colorable, non-probative conjecture to defeat summary judgment) (quoting Anderson, 477 U.S. at 249–50, 106 S.Ct. 2505).

What’s the takeaway?

It’s hard to look at a legal document that says it’s one thing (a revocable trust) and realize it’s really something else (a deed). Years of experience and all the heuristics we use on a daily basis as lawyers work against you. Which is to say, I don’t think you can develop the kind of professional discernment needed to make this kind of mental leap without years of specialized experience under your belt. And that kind of experience is rare, especially in the probate context. Fortunately for the surviving spouse on the winning side of the Fuentes case she had the good fortune to hire two of the very small number of attorneys up to that task: Eric Virgil and Stacy Rubel. Kudos to both of them for a job well done.